In the fast-paced world of forex trading, proprietary firms (prop firms) are rapidly evolving. To stay competitive, efficient, and compliant in 2025, more and more firms are turning to one powerful tool: the Forex CRM.

Whether you’re a startup launching with an MT5 grey label or an established forex broker using a MT4 white label, a solid Forex CRM (Customer Relationship Management system) is essential. It helps manage clients, streamline operations, and drive growth.

Let’s explore why Forex CRMs have become indispensable for prop trading firms and how the right system can give your firm a winning edge.

What Is a Forex CRM?

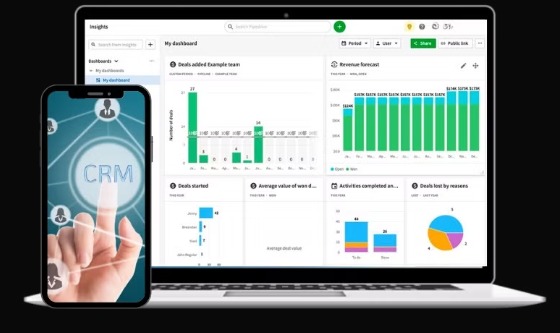

A Forex CRM is a platform designed to manage all the back-office operations of a forex broker or prop firm. Unlike general CRM systems, a Forex CRM integrates with trading platforms like MT4 and MT5, handling everything from trader onboarding and document verification to analytics, commission tracking, and support.

For proprietary trading firms, this CRM acts as a central control system — giving clear visibility into trader performance, account funding, and risk exposure.

Why Are Forex CRMs So Important for Prop Firms?

1. Centralized Management

Prop firms deal with dozens or even hundreds of traders. Managing all their accounts manually is nearly impossible. A Forex CRM gives you a centralized dashboard where you can:

- View all active traders

- Monitor trades in real-time

- Track profit/loss reports

- Analyze trader behavior

This level of control is vital whether you’re using a MT5 white label, MT4 grey label, or any trading model.

2. Seamless Onboarding & KYC

New trader onboarding can be time-consuming. A Forex CRM automates:

- KYC (Know Your Customer) document submission and verification

- AML (Anti-Money Laundering) checks

- Approval or rejection workflows

With automation, you can onboard multiple traders quickly and remain compliant — especially useful if you’re operating under a MT5 grey label or MT4 white label license.

3. Real-Time Platform Integration

Top Forex CRMs integrate directly with MT4 and MT5 platforms. This means:

- Real-time syncing of accounts

- Immediate updates on deposits/withdrawals

- Trade monitoring and alerts

- Account balance tracking

Whether you use an MT4 white label or a MT5 grey label, this integration is vital for a seamless experience.

4. Enhanced Risk Management

In proprietary trading, managing risk is everything. Forex CRMs help with:

- Setting individual trader risk limits

- Monitoring drawdowns

- Receiving alerts for unusual trading behavior

- Tracking max loss/exposure settings

You can identify risky traders before they cause financial damage — a major advantage for fast-scaling firms.

5. Affiliate & IB Commission Management

Many prop firms grow through Introducing Brokers (IBs) or affiliate networks. A good Forex CRM helps:

- Track referrals

- Manage multi-level commission structures

- Generate affiliate reports automatically

This supports rapid expansion and rewards your best-performing partners.

6. Performance Analytics for Prop Traders

Forex CRMs give detailed insights into each trader’s performance:

- Daily, weekly, and monthly reports

- Win/loss ratios

- P&L trends

- Consistency scores

If you’re funding traders or scaling accounts based on performance, this data is priceless.

Key Features of a Forex CRM for Proprietary Trading

When choosing a Forex CRM, especially in 2025, look for these features:

1. Compatibility with MT4 and MT5

Ensure it supports both MT4 grey label and MT5 white label integrations. This gives you flexibility as you scale.

2. Branded Client Portal

Give traders a professional portal to:

- View trading stats

- Upload documents

- Make deposits and withdrawals

- Submit support tickets

This improves user experience and saves support time.

3. Admin Control Panel

From one place, you should be able to:

- Manage traders

- Set permissions

- Track activity logs

- Access compliance data

It puts everything you need in one dashboard.

4. Built-in Payment Gateways

Look for CRMs that integrate with major payment processors for fast and secure transactions.

5. Support System Integration

Integrated ticketing and live chat features help your team handle trader requests efficiently.

Real Use Cases: How Forex CRMs Power Prop Firms

🔹 Funded Trader Programs

If your prop firm runs challenges or evaluations, the CRM can automatically:

- Track trading targets

- Approve progression to funded stages

- Notify traders about milestones

Scaling Operations Globally

A cloud-based Forex CRM helps manage traders in different time zones, with separate IBs and regional admins.

Regulatory Compliance

In 2025, regulations are tighter than ever. With built-in audit logs, KYC tracking, and AML checks, your CRM helps ensure legal compliance — critical if you’re on a MT4 grey label under a third-party license.

Forex CRM vs No CRM – The Difference

| Feature | With Forex CRM | Without Forex CRM |

| Trader Onboarding | Automated & Fast | Manual, time-consuming |

| Compliance | Integrated KYC/AML | Risk of fines & violations |

| Trader Monitoring | Real-time analytics | Disconnected reports |

| Affiliate Management | Automated tracking | Manual spreadsheet tracking |

| Growth Scaling | Easy to expand with control | Chaotic and disorganized |

Why You Need a CRM – Even with a Grey Label

Some new brokers using MT4 grey label or MT5 grey label think a CRM isn’t needed yet. That’s a mistake.

Even with a grey label, your CRM gives you:

- Front-end branding and control

- Back-end insights on trader behavior

- Operational efficiency

- Competitive edge in the trading space

It’s the first step toward scaling like a full-fledged forex broker.

Conclusion

If you’re running or planning a proprietary forex trading firm in 2025, a robust Forex CRM isn’t optional — it’s essential.

From onboarding and compliance to trade analytics and affiliate management, the CRM is the engine behind your growth. Whether you’re operating under a MT4 white label, MT5 white label, or launching via a MT5 grey label, your CRM will help you launch fast, manage smart, and grow sustainably.

Choose wisely — because in today’s forex world, success is all about systems.